Get a Quote for Health Insurance Coverage in Under 5 Minutes

How soon are you considering to purchasing health insurance?

What type of health insurance coverage do you currently have?

What's your full name?

What's your state and zip code?

What's your household income?

What's your age?

Thanks Timothy, your quote is ready!

Legacy Health Savings Quotes

Protect Yourself and Your Family With Smarter, More Affordable Health Coverage

Finding the right health coverage shouldn’t be stressful or overpriced. That’s why we built the Legacy Smart Coverage Tool to help you quickly compare smarter plans, secure better rates, and protect the people who matter most. Get coverage that fits your lifestyle, your needs, and your budget with confidence.

The Right Health Plan

Can Change Everything

Health insurance doesn’t have to be complicated or overpriced.

We make it simple, fast, and stress-free:

🛡️ A Real Advocate on Your Side

No upsells. No pressure. Our licensed U.S. agents recommend what’s best for you, not what makes someone else money.

🧠 Guidance You’ll Actually Understand

We explain your options like a human, not a robot. You’ll finally know what your coverage means, and what it protects.

💸 Coverage That Starts When You Need It

Most people save 20–40% and can be fully covered by tonight. That’s peace of mind, without the overpriced premiums.

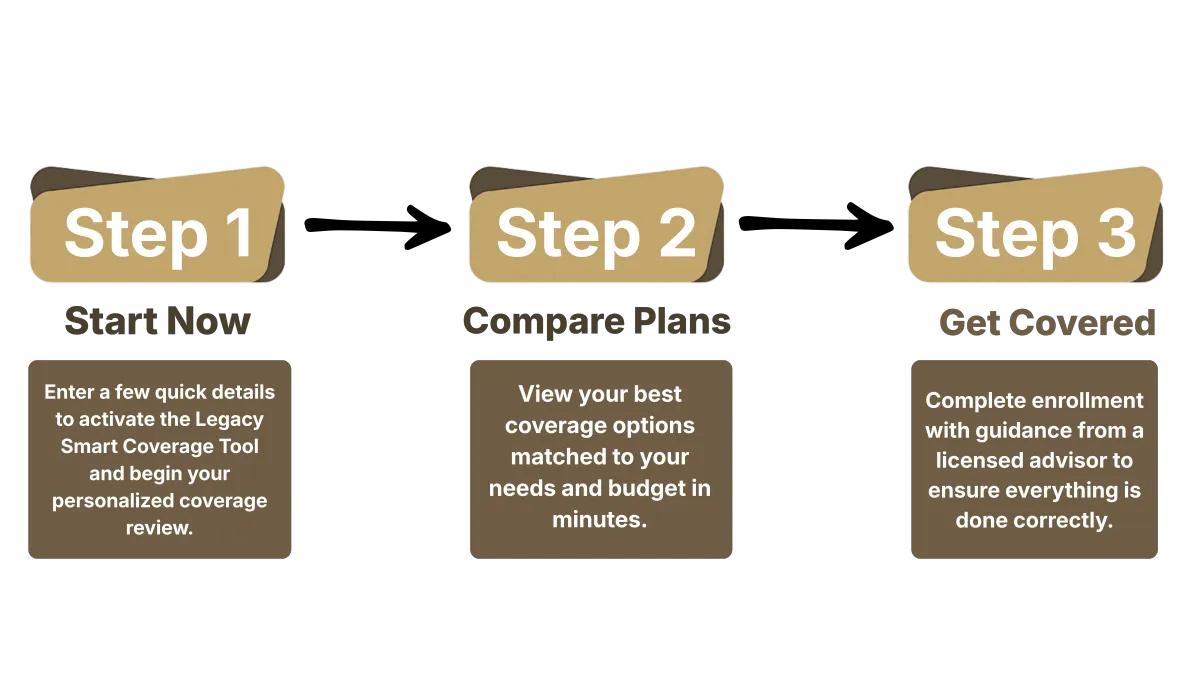

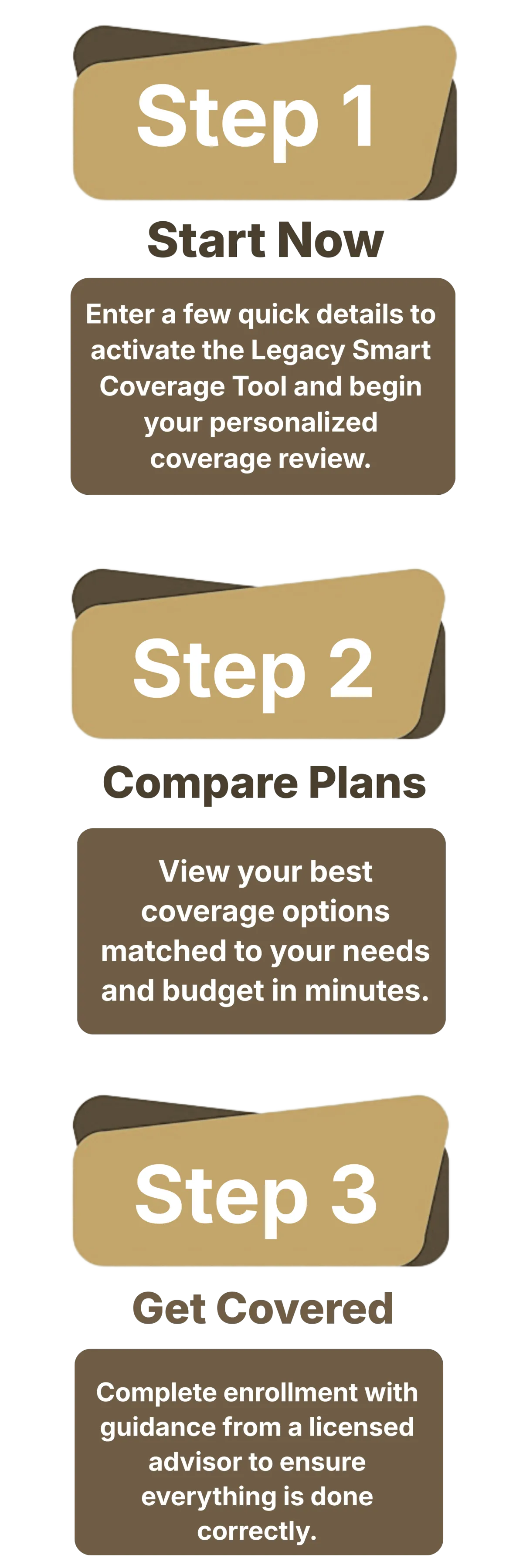

3 Simple Steps to Better Coverage Without the Stress

Who We Help

Still Paying Too Much for the

Plan at Work?

Just because your employer offers a plan doesn’t mean it’s the best deal. Many people find lower-cost, better-fit options by shopping individually.

Freelancer, 1099 or a Small

Business Owner?

We’ll help you find affordable coverage built for self-employed income: including marketplace and private plans you may not know exist.

Between Jobs or Recently

Lost Coverage?

We get it, losing benefits is stressful. But there are short-term and long-term plans available right now that can give you peace of mind.

Have Questions?

What is health insurance?

Health insurance is a financial protection plan that helps cover the costs of medical care, including hospital visits, surgeries, emergency treatments, routine checkups, and prescription medications. Its primary purpose is to transfer financial risk from you to the insurance company, protecting you from overwhelming medical expenses that could arise from unexpected health issues.

Who needs health insurance?

Everyone should have health insurance coverage. Medical emergencies and health issues can happen to anyone at any time, regardless of age or current health status. Having coverage is the most effective way to protect yourself and your family from potentially devastating medical costs.

How much does health insurance typically cost?

Costs vary based on location, age, household size, and coverage type. Using the Legacy Smart Coverage™ Tool, we help you compare options and identify plans that fit your budget and coverage needs.

How do I choose the best insurance plan?

Choosing the right health insurance plan requires careful consideration of your healthcare needs and budget. Compare multiple plans and consider factors like:

- Monthly premium costs

- Deductibles and out-of-pocket maximums

- Coverage for your preferred doctors and hospitals

- Prescription drug coverage

- Specific services you might need

Working with licensed insurance professionals can help you understand your options and find coverage that meets your specific needs and budget.

How does health insurance work?

You pay a monthly premium to maintain coverage. When you receive medical care, your plan helps cover eligible expenses after applicable deductibles or copays, depending on your policy.

What are the different ways to get health insurance?

You can obtain health insurance through several channels:

- Employer-sponsored group plans

- Government marketplace websites

- Directly from insurance companies

- Licensed insurance brokers and agents

- Healthcare sharing ministries

- Short-term coverage options

What is open enrollment?

Open enrollment is the yearly period when individuals can enroll or change health plans. Outside of this window, you may still qualify through a special enrollment period due to life events such as marriage, job changes, or relocation.

What are premiums, deductibles, and copays?

Premiums: The monthly amount you pay to maintain your health insurance coverage.

Deductibles: The amount you must pay for healthcare services before your insurance begins to share costs.

Copays: Fixed amounts you pay for specific services (like doctor visits) regardless of whether you've met your deductible.

Coinsurance: The percentage of costs you pay after meeting your deductible, until you reach your out-of-pocket maximum.

What types of health insurance plans are available?

Common types of health insurance plans include:

HMOs (Health Maintenance Organizations): Lower costs but require you to use network providers

PPOs (Preferred Provider Organizations): More flexibility to see any provider, with lower costs for in-network care

High-Deductible Health Plans (HDHPs): Lower premiums with higher deductibles, often paired with Health Savings Accounts

Short-term plans: Temporary coverage for gaps between other insurance

Catastrophic plans: Low premiums with very high deductibles, mainly for emergency protection

What is a Health Savings Account (HSA)?

A Health Savings Account is a tax-advantaged savings account available to people with qualifying high-deductible health plans. You can contribute pre-tax dollars to pay for eligible medical expenses, and unused funds roll over year to year. HSAs offer triple tax benefits: deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

What if I am self-employed or unemployed?

Self-employed: You can purchase individual health insurance through the marketplace, directly from insurers, or work with licensed agents to find suitable coverage options.

Unemployed: You may qualify for COBRA continuation coverage from a previous employer, Medicaid, or special enrollment periods on the marketplace. Short-term health insurance might also be an option for temporary coverage gaps.

Is there a penalty for not having health insurance?

The federal penalty for being uninsured was eliminated, but some states still impose their own requirements and penalties. More importantly, the real risk of being uninsured is facing substantial medical bills that could create financial hardship in the event of an accident or serious illness.

Legacy Page Financial

Built on Faith, Family, Financial Freeodm

Legal & Trust

Copyright 2026. Legacy Page Financial. All Rights Reserved.